Surcharging

News about surcharging and consumer fees

Cash

+12

Dec 17, 2025

•

Massive year in payments but 2026 looms even larger

There will be little rest for the payments industry this summer, as businesses, regulators and lawmakers get ready for a raft of big changes in the New Year. In the final edition of PayDay News for 2025, we look at the big changes this year, and what to expect in 2026.

Fintech

+3

Oct 8, 2025

•

Zeller sets sights on UK’s £1.3 Trillion SME Market

Melbourne blended rate PSP Zeller has set its sights on the UK as the first step in a “global expansion” strategy.

Fintech

+6

Sep 17, 2025

•

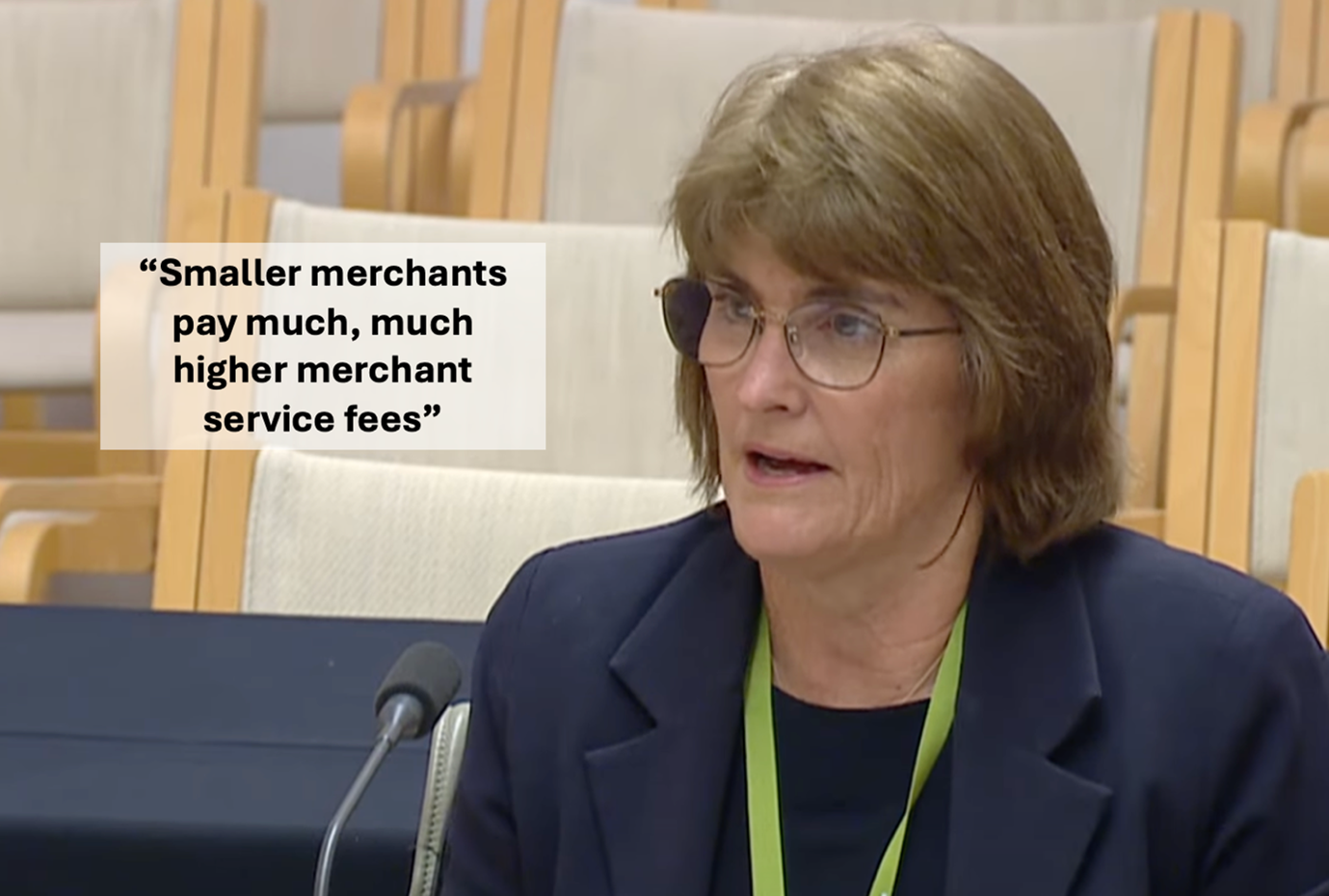

With no consensus on card fees and surcharging, will the public interest prevail?

If the Reserve Bank wants consensus on its proposal for merchant fees and surcharging, it’s a lost cause. The best the central bank can hope for is a decision in the public interest, leveraging strong sentiment on issues such as scheme fees, least-cost routing and the burden on small business.